Bottom line: Lattice Semiconductor's sale to a Chinese buyer stands a 50-50 chance of getting national security clearance, benefiting from warming ties between the US and China and lack of defense-related technologies involved.

-

- Lattice still trying to sell to Chinese buyer

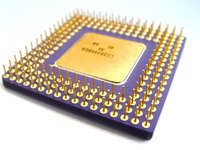

More than a year after it first became an acquisition target for chip-hungry Chinese buyers, Lattice Semiconductor (Nasdaq: LSCC) is back in the headlines again with what looks like a last-ditch effort at salvaging a sale. Lattice is clearly a mid-sized maker of microchips that fits the profile of what Beijing would like to buy, with a market cap of about $840 million, as China tries to build up its own semiconductor sector that can compete with global giants like Intel (Nasdaq: INTC), Qualcomm (Nasdaq: QCOM) and TSMC (Taipei: 2330).

But western governments are wary of China's aggressive ambitions, which include generous funds for M&A of Asian and western chip makers. A deal first announced more than a year ago saw one of the most aggressive buyers, Tsinghua Unigroup, buy a small stake in Lattice, but then fail to parlay that into an outright acquisition. Now another group, Canyon Bridge Capital Partners, is getting ready to make a third appeal for its plan to purchase Lattice in a filing to the regulator that reviews such deals for national security considerations.

I haven't followed this story particularly closely, though I was aware that quite a while had passed since Canyon Bridge made its original bid last November. (previous post) That means it's now been 8 months since the deal was announced, and apparently Canyon Bridge has filed twice for approval from the Committee on Foreign Investment in the United States (CFIUS), which reviews such deals for national security concerns.

Now media are reporting Canyon Bridge will submit its proposal for a third time, following previous submissions in January and March. (English article) It appears from one of the reports that a deadline is approaching for the March application (English article), since such reviews normally aren't supposed to go longer than 75 days. Thus making a new filing gives CFIUS another 75 days to consider the deal.

Apparently this kind of third submission to CFIUS for the review of a deal is extremely rare, as it really shouldn't take that much time to make a determination. But there are a few sticky factors this time, led by Canyon Bridge's desire to show its money isn't coming from Beijing. The other factor apparently lies in the fact that this latest deal came right in the transition from the previous US Obama administration and the new Trump one.

That latter point is interesting, as we really haven't had any tests yet of Trump's attitude towards the whole national security debate. The last such deal to splash into the headlines came last fall under Obama, who took the rare move of vetoing the sale of German chip maker Aixtron to a Chinese buyer on national security grounds. (previous post)

Warming Political Climate

A few months ago many probably would have said this Lattice deal, which values the company at $1.3 billion, stood very little chance of getting cleared by Washington. Back then, Trump wasn't very friendly towards China and was still sounding plenty of anti-Beijing rhetoric about the country's currency manipulation and stealing US jobs. But since then the tenor in the relationship has changed quite a bit, as Trump realizes that China isn't such a bad guy after all and also that he needs Beijing's help in addressing the issue of containing North Korea's nuclear program.

At the end of the day, this particular deal will still get the same kind of scrutiny that all such deals get, though perhaps the risks of politicization are slimmer. Much will probably come down to whether or not Lattice does any work for government organizations, especially defense, and whether its chips are used in any sensitive applications.

Lattice points out that none of its chips, which are used in laptops and smartphones, have particular military applications and that all of its manufacturing is outsourced. Given that and the warming political climate between Trump and China, I would say the deal, which has an August 1 deadline under the agreement between the two sides, could have a reasonable chance of getting cleared, perhaps around 50-50.

0

推荐

京公网安备 11010502034662号

京公网安备 11010502034662号